Bachelor of Commerce (Honours) in Financial Technology

Programme Information:

Our programme is selected by the Hong Kong Government to join the Study Subsidy Scheme for Designed Professions (SSSDP) since 2021/2022. The intake places of our programme are mainly allocated through the Joint University Programmes Admissions System (JUPAS).

| Admissions Exercise | |

| Funding Category | SSSDP |

| JUPAS Code | JSSY01 |

| Study Level | Bachelor's degree |

| Programme | Bachelor of Commerce (Honours) in Financial Technology |

| No. of Subsidized Places in 2025/26 (Local Students Only) | 30 |

| Maximum Places for Direct Admission for Unfilled Intakes in 2025/26 (20% of Subsidized Places) | 6 |

| Annual Tuition Fee |

HK$80,089 (2026/27 entry local students) HK$33,309 (2026/27 entry local students after deduction of SSSDP subsidy of $46,780) HK$110,089 (2026/27 entry non-local students) |

| Duration of Programme | Four Years |

| Mode of Attendance | Full-time |

| Minumum Credits Required for Award | 125 credits |

|

Admissions Requirement and Procedure (All application and admission procedures and regulations are subject to the latest information published on the University Admissions Office's official website) |

HKDSE Applicants

#HKSYU allows NCS applicant (2025-26 Entry) to use alternative qualifications for fulfilling the Chinese Language requirements. See details on our Admissions Office website.

^The ‘Attained’ level in the subject ‘Citizenship and Social Development’ can be counted as Level 2 and included in the score calculation of the best five subjects. Applicants with previous HKDSE subject result of A040 ‘Liberal Studies’ can be used as the alternative of the core subject requirement of A045 ‘Citizenship and Social Development’. Admissions requirements may vary from time to time, applicants are reminded to browse the latest admissions details shown in this website or contact our admissions staff before application.

*The following subjects can be accepted as an elective subject:

Applied Learning subject (ApL). Maximum of one relevant ApL can be counted. 'Attained with Distinction (II)' and

'Attained with Distinction (I)' is comparable to level 4 and level 3 respectively. 'Attained' in ApL will not be considered.

ApL Chinese cannot be used as an elective subject.

- Category C subjects (Other languages). Maximum of one Cat. C subject can be counted. Grade E or above is required.

- Mathematics Extended Part M1 and M2 can be counted.

Priority will be given to students who have achieved Level 3 or above in Mathematics and/or Information and Communication Technology

Applications for admission to this programme under SSSDP should be submitted through JUPAS.

Non-Local Applicants and Sub-Degree Applicants please see details on our Admissions Office website |

| Average Score | 16.95 (2025 intake, calculated based on best 5 Subjects) |

| Scoring Method | The admission score of 2025/26 is calculated based on the converted points of the best five DSE subjects as follows: |

| Catagory A: Senior Secondary Subjects | |||||||

| Level | 5** | 5* | 5 | 4 | 3 | 2 | 1 |

| Score | 7 | 6 | 5 | 4 | 3 | 2 | 1 |

| Category B: Applied Learning Subjects^ | |||||||

| Level | Attained with Distinction II | Attained with Distinction I | Attained | ||||

| Score | 4 | 3 | N/A | ||||

| ^ Remark: Applicants can use at most one relevant Applied Learning subject (ApL) as an elective subject. | |||||||

| Category C subjects (Other languages). Maximum of one Cat. C subject can be counted. From 2025-26 entry onward, the following level can be counted as Level 2 and included in the score calculation of the best five subjects: | |||||||

| Subjects | Reported levels | ||||||

| Japanese | N2 or above pass | ||||||

| Korean | Grade 4 or above pass | ||||||

| French/German/Spanish | Grade B or above pass | ||||||

| Urdu (International) | Grade C or above | ||||||

About the Programme

Programme Aims

1. Develop students’ capacity for critical and independent thinking so that they can solve FinTech-related problems;

2. Equip students with a wide range of transferable skills in finance, technology, applied data science, law, economics and business; and

3. Prepare students for future technological and digital transformation in the finance industry.

Internship

Each student has an internship opportunity to work in a business or financial enterprise in order to broaden horizon beyond the classroom. It enables students to apply their academic and transferrable working skills to the real world practice.

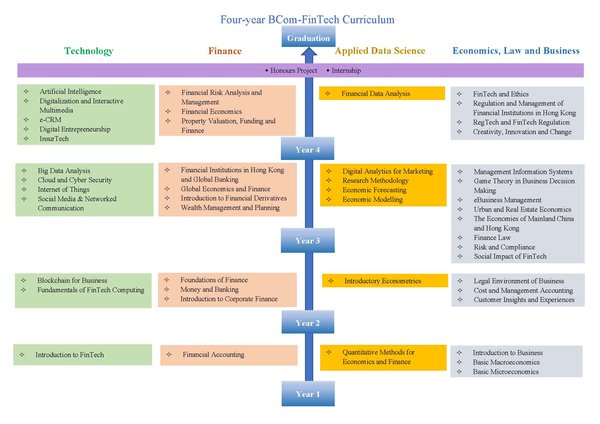

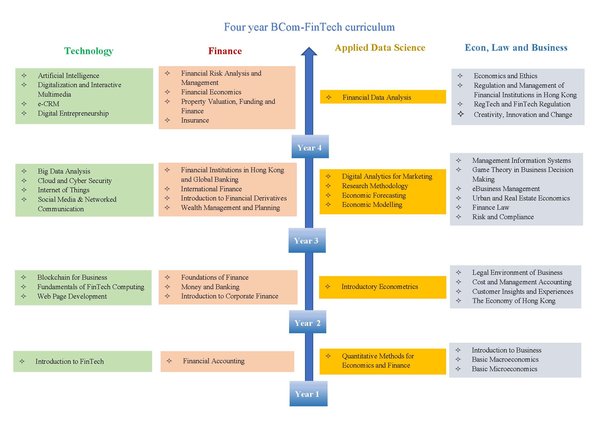

Curriculum

Alumni Series:

Students (Major in FinTech) who wish to broaden their level of expertise and enhance their prospects of future career development can study a Minor in another subject. The minimum credit requirement for a Minor is 15. See more details here.

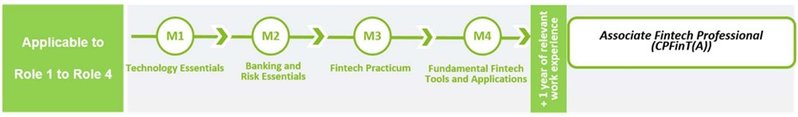

Certification

Enhanced Competency Framework on Fintech (ECF-Fintech) is a collaborative effort of the HKMA, the Hong Kong Institute of Bankers (HKIB) and the banking sector in establishing a set of common and transparent competency standards for developing a strong Fintech talent pipeline and enhancing the professional competence of existing banking practitioners who are performing functions that involve technological innovation for financial services in Hong Kong’s banking industry. It is aimed at “Relevant Practitioners” located in the Hong Kong office of an Authorized Institute whose primary responsibilities are to perform one or multiple job roles listed in the table below.

| Job Roles | Role Description (Core Level) |

|---|---|

| Role 1 – Fintech Solution Development | Design, develop, test, and deliver the core functional and technical aspects of Fintech solutions for the AI. Work closely with cross-functional teams, and coordinate projects on Fintech solutions throughout the software development lifecycle. |

| Role 2 – Fintech Product Design | Design and develop new Fintech products with innovative features and functionalities driven by user needs or market forces. |

| Role 3 – Fintech Strategy and Management | Assist in the research and execution of Fintech strategy, and manage the Fintech initiatives of the AI in collaboration with internal stakeholders and external vendors and partners. |

| Role 4 – Regtech | Assist in Regtech research, use case formulation, regulatory and business requirements consolidation, vendor selection and Regtech solution development, etc. along the Regtech adoption journey to enhance the efficiency and effectiveness of the AI’s risk management and regulatory compliance. |

Graduates of BCom (Hon) in Financial Technology are eligible to apply for exemption on Modules 1, 2 and 4 of the ECF-Fintech Core Level training programme. By completing Module 3 and obtaining at least 1 year of relevant work experience, they may apply for certification as an Associate Fintech Professional (CPFinT(A)).